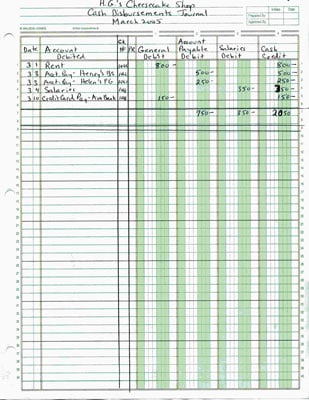

The utilization of a general ledger template can solve all your accounting issues. If you are a small business entity and you are looking for a method to track and record your financial transactions, then using a ledger is your best possible solution. The ledger may include account maintenance for elements like: The general ledger is a basic document that is used to get the information required to formulate the financial statements of a company like the balance sheet and income statement.

This is a perpetual document and is maintained in a company throughout its life.

For example, the $500 check adds to your business's cash, so it would be labeled 4/20/15, Cash. Accounts are ways to think of how your money is being spent or earned. Step 2: Under Gateway of Tally on the screen, select Accounts Info. The following Ledger accounts example provides an outline of the most common Ledgers.

This is where the vocabulary of accounting is especially handy. For creating a single ledger in Tally ERP 9, users must follow the following steps: Step 1: First, go to Gateway of Tally. This article has been viewed 586,326 times.Ĭategorize the "account" of the transaction. This article received 22 testimonials and 93% of readers who voted found it helpful, earning it our reader-approved status. WikiHow marks an article as reader-approved once it receives enough positive feedback. There are 9 references cited in this article, which can be found at the bottom of the page. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics. Casting Separating debit and credit amount. Folioing Put the page number for a journal entry on the ledger account’s folio column. Posting transactions from journal to respective ledger account. She holds a BS in Accounting from Georgia State University - J. So, the 5 simple steps for writing and preparing ledger are Drawing the Form Get pen and paper, start drawing the ledger account. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. This article was co-authored by Keila Hill-Trawick, CPA.

0 kommentar(er)

0 kommentar(er)